Invest in pre-leased commercial assets and curated real-estate portfolios that deliver predictable monthly cashflow and long-term wealth appreciation. Our data-driven platform simplifies every step so you can grow passive income today.

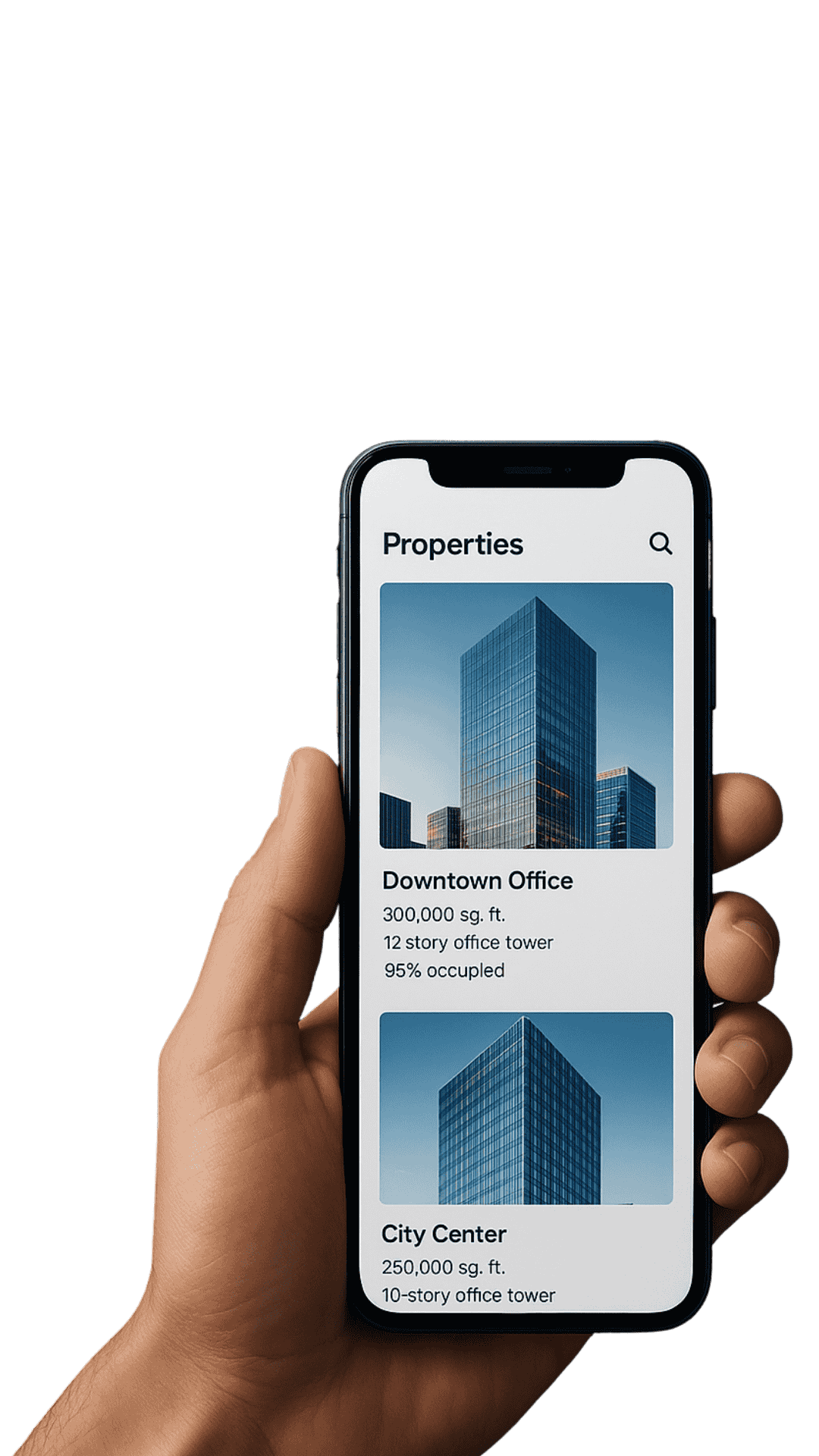

Browse pre-leased commercial assets, view AI-driven yield forecasts and reserve your fraction in minutes. All listings include virtual tours, legal reports and transparent pricing.

We combine deep asset expertise with cutting-edge technology to unlock institutional-grade commercial real-estate opportunities for every investor. Our AI-powered underwriting engine, 24/7 asset monitoring and fractional ownership model deliver transparency, liquidity and superior risk-adjusted returns.

Backed by SEBI-registered trustees and an independent escrow mechanism, every rupee you deploy is ring-fenced and auditable in real time. From acquisition to exit, our ISO-certified processes, quarterly investor calls and on-demand capital-market insights keep you informed, empowered and in control of your commercial real-estate portfolio.

Stay ahead of market cycles with weekly CRE trend reports, rental yield heat-maps and cap-rate forecasts. Our research covers micro-market supply, tenant credit scores and exit liquidity so you invest only in high-performing assets.

Whether you seek 8–12 % IRR or passive monthly rentals, our platform equips you with everything needed to evaluate, fund and monitor commercial properties in minutes.

Vetted pre-leased offices, warehouses and retail assets with detailed due-diligence reports and 3D virtual tours.

Machine-learning models analyse tenant credit, lease terms and macro data to forecast cashflows and downside risk.

Start investing with ₹25 lakh and co-own marquee properties while earning proportionate rent and capital gains.

Track rental receipts, occupancy rates and IRR in real time across your entire portfolio on web or mobile.

Our asset managers handle leasing, maintenance and compliance so you enjoy truly passive income.

Resell your fractions on our secondary market or opt for asset buy-back after lock-in—exit when you decide.

Browse curated listings → Analyse AI reports → Invest online in minutes → Monitor returns 24/7. Transparent, secure and entirely digital.

From minimum ticket sizes to taxation on rental income, find quick clarity on everything you need before investing in commercial real estate.

You can begin fractional ownership in pre-leased Grade-A properties with as little as $30,000, enabling diversification across multiple assets without large capital outlays.

Monthly rentals flow directly from the tenant to an escrow account managed by an independent trustee. After statutory deductions, your pro-rata share is credited to your registered bank account on the 7th of every month.

Our asset-management team activates a 90-day re-leasing playbook—market analysis, broker outreach, fit-out subsidies and digital marketing—to secure a new tenant. Historical data shows average re-leasing within 75 days, and a reserve fund covers any interim income shortfall.

Yes. Every special-purpose vehicle (SPV) is incorporated under Indian LLP regulations, filings are made with the Registrar of Companies, and trustees are registered with SEBI. Additionally, all investment documents are executed on non-judicial stamp paper and stored in a blockchain-backed vault for tamper-proof record keeping.

Your fractional ownership is recorded in the LLP agreement and reflected in the MCA (Ministry of Corporate Affairs) filings. A tri-party deed among the LLP, trustee and you ensures enforceable rights to rental income, capital appreciation and exit proceeds.

After a 12-month lock-in, you may:

• List your fraction on our secondary market for peer-to-peer sale, typically transacted within 5–10 business days.

• Opt for our buy-back window held every quarter at a NAV-based price discovered by an independent valuer.

• Hold until asset divestment (target 5–7 years) and receive proportional sale proceeds.

Rental income is distributed after withholding tax under applicable DTAA provisions. Capital gains on exit are classified as short-term or long-term based on holding period; we provide a detailed Form 64 and CA-certified statement every March to simplify your tax filing.

We combine deep asset expertise with cutting-edge technology to unlock institutional-grade commercial real-estate opportunities for every investor. Our AI-powered underwriting engine, transparent reporting and fractional ownership model deliver superior risk-adjusted returns from day one.

Join 10,000+ investors who receive early-bird access to high-yield properties, market insights and invite-only webinars. One-click unsubscribe at any time.

NexGen PropTech unlocks institutional-grade commercial real estate for every investor through transparent data, AI-powered underwriting and fractional ownership—delivering resilient cash-flow and long-term wealth creation worldwide.

NexGen PropTech unlocks institutional-grade commercial real estate for every investor through transparent data, AI-powered underwriting and fractional ownership—delivering resilient cash-flow and long-term wealth creation worldwide.